In late Q3 of last year we counted 393 private company ‘unicorns’ (valuations >$1 Billion) and wrote an analysis of funding trends[1]. We charted how late-stage funding rounds were trending larger, but these supergiant rounds ($100+ million) were consolidating behind a fewer number of startups in a winners-take-all funding scenario.

Our conclusion at the time: cash-rich unicorns are using their resources for defensive and strategic M&A, and the exit path for your company is most likely acquisition.

Now, according to Crunchbase research[2], the number of unicorns stands at 603, with an aggregate valuation of more than $2 Trillion. These 603 companies raised an average of $735 million apiece in venture funding. So the consolidation in late-stage funding continues to be as real as ever.

Monopoly Money

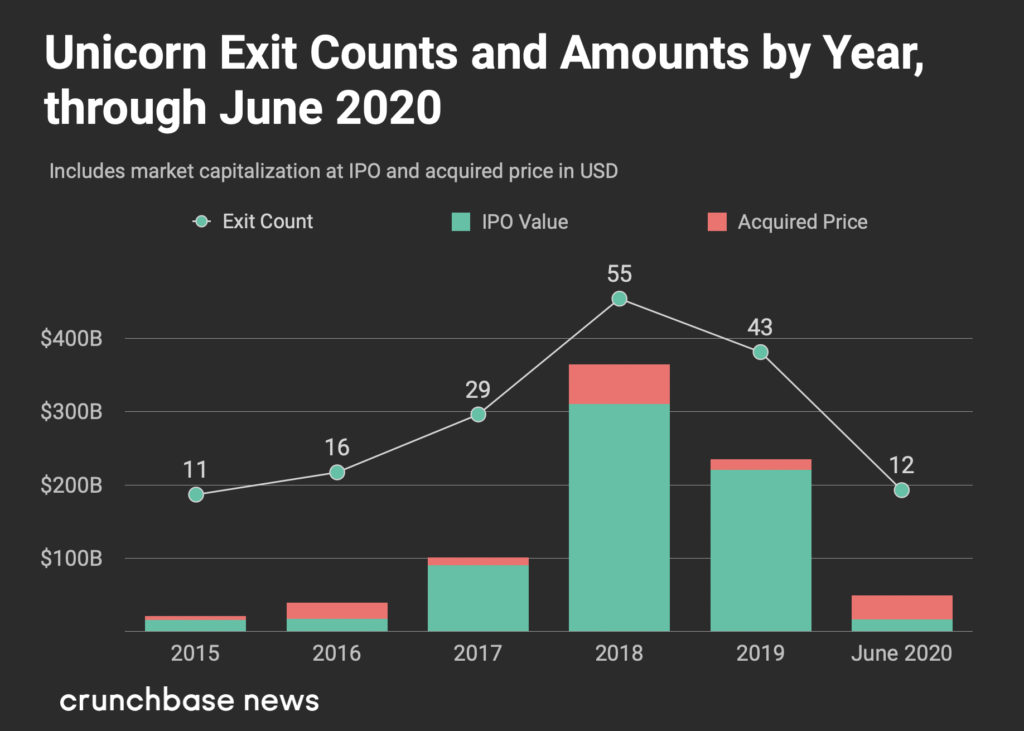

Not only do unicorns have war chests of investor cash, a growing number of them have stock. Despite some high-profile IPO flameouts in 2019, unicorn IPOs lately have been doing pretty well, thank you. The aggregate market capitalization at exit for the 12 companies that have gone public through June of 2020 is $50 Billion, which is a 92% increase over their last recorded private valuations when it totaled $26 Billion:

NOTE: The key metric in this chart—the delta between the red and green bars—is not as clear as it could be. Valuation increases have averaged 28% for the past half-decade, but 2020 year-to-date increase is 92%.

Why Should You Care?

Nay-sayers will point out that, in the land of regular horses, M&A activity in 2020 has dropped off significantly with more than $100 Billion in M&A deals being canceled on account of Covid-19 disruptions[3] (and that’s in the US alone). It’s true. But M&A transactions are still happening—because cash needs someplace to invest. In the US, private equity firms are holding $2.4 trillion in available cash for acquisitions, and corporations can access another $2.2 trillion[4].

Anecdotally, our long-time client Avira GmbH closed their acquisition deal with Investcorp on April 8th, at the height of the Covid panic. Their PE buyers are using Avira as an anchor around which to aquire even more companies. A number of technology companies in sectors like cyber security, remote learning, ecommerce and elsewhere have seen their revenues and M&A attractiveness actually increase precisely because of Covid.

Some of the significant-size M&A announcements[5] so far this year include:

| ACQUIRER | TARGET | PRICE |

| HPE | SilverPeak | $925,000,000 |

| SUSE | Rancher | Pending |

| Uber | Postmates | $2,600,000,000 |

| North | Pending | |

| Amazon | Zoox | $1,200,000,000 |

| MasterCard | Finicity | $825,000,000 |

| Microsoft | CyberX | Pending |

| Cisco | ThousandEyes | Undisclosed |

| Microsoft | Softomotive | Undisclosed |

| Giphy | $400,000,000 | |

| Microsoft | Metaswitch Networks | Undisclosed |

| Vmware | Octarine | Undisclosed |

| Atlassian | Halp | Pending |

| Zoom | Keybase | Undisclosed |

| Sinch | SAP Digital Interconnect | $198,000,000 |

| Intel | Moovit | $1,000,000,000 |

| NVIDIA | Cumulus Networks | Undisclosed |

| NVIDIA | Mellanox | $6,900,000,000 |

Optimize your Attractiveness for M&A

The unicorn phenomenon has set the bar pretty high for companies to get to IPO, and the late-stage investor cash needed continues to consolidate which, in turn, drives M&A activity. Our advice from last Q3 still holds: start thinking about how to position your company to attract M&A attention, and optimize your key metrics and drivers that predict to higher purchase valuation.

XROCKET.io is a new breed of sell-side advisory that helps entrepreneurs position and optimize for acquisition well before they hire an M&A banker. If you know a company that is considering M&A in the 1-2 year future, contact us at m.addison@xrocket.io.

Sources:

[1] https://www.xrocket.io/will-unicorn-funding-consolidation-mean-an-ma-exit-for-your-company/

[2] https://news.crunchbase.com/news/private-unicorn-board-now-above-600-companies-valued-at-2t/?utm

[4] https://www.pwc.com/us/en/services/deals/library/year-end-review-outlook.html

[5] https://www.computerworld.com/article/3513439/biggest-technology-acquisitions-2020.html